5 Ways Tampa First Time Homebuyers Can Beat High Mortgage Rates

Are you a first-time homebuyer ready to make one of the biggest purchases of your life? Maybe you're already in the process of purchasing and you want to get everything right to ensure that your mortgage payments stay low.

Well, we have the perfect blog post for you!

Every homebuyer runs the other way when mortgage interest rates start touching the 7's and 8's.

But, what happens when rates are super low? Every first time homebuyer in Tampa wants to buy a house and that can be a bad thing because now you have competition with homes be snatched up quickly.

So, getting in the game of buying a house when rates are high is a smart thing. You just need to know these first time homebuyer tips to get you foot in the door in the smart way.

It's your lucky day because I have listed those for you below and it will help you get the best payment that you can get without the competition of other homebuyers beating you to the home of your dreams.

What are Builder incentives and how do they benefit First time home buyers?

Builder incentives are financial benefits that property builders offer to attract potential buyers around the Tampa Bay area. One such incentive is a rate buy down, where the builder pays to lower the interest rate for the buyer's mortgage.

This strategy can significantly decrease the buyer's monthly payment, making homeownership more affordable, especially for first-time buyers. This reduction in the interest rate and subsequent lowering of monthly mortgage payments can make the home-buying process less daunting, notably for those entering the market for the first time.

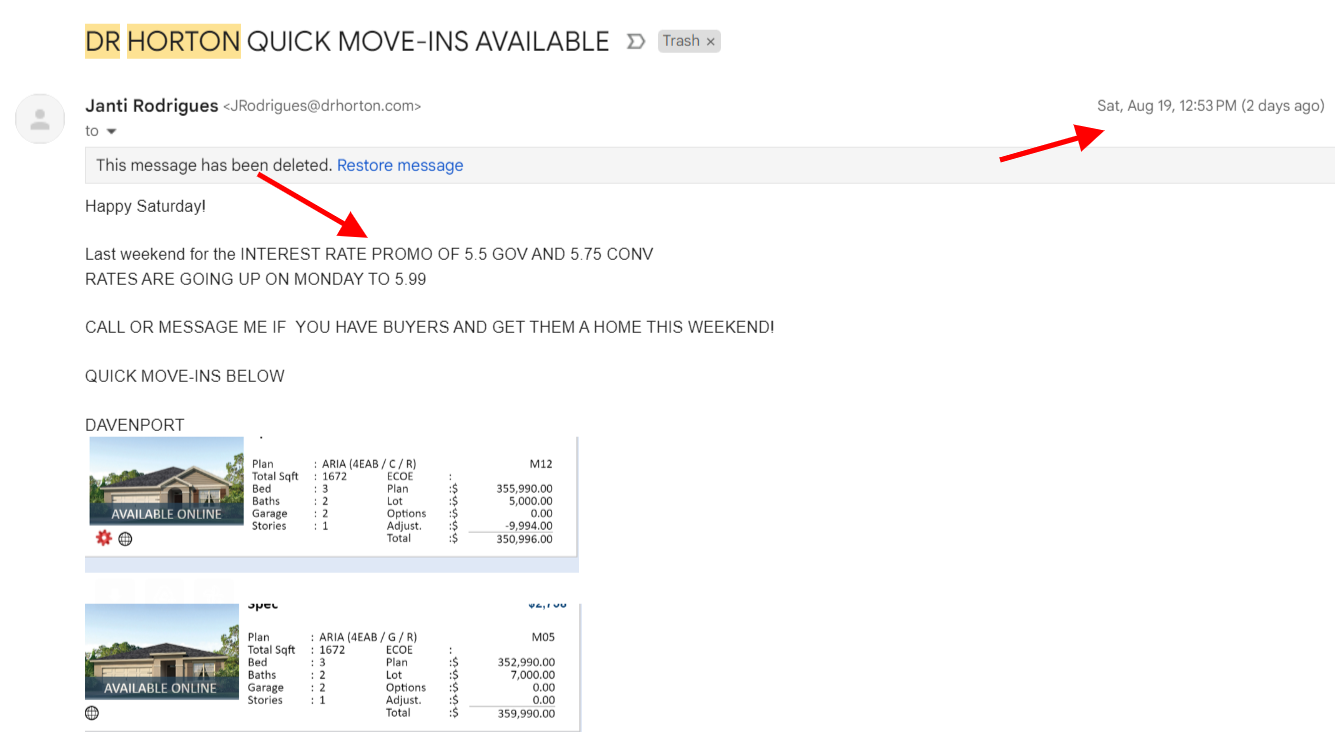

New home construction builders in Tampa such as DR Horton, Casa Fresca and other builders are offering incentives on select homes with very low rates. We are talking rates in the low 5's that can lead and saving your thousand's of dollars.

Note, select homes is a key word there for some builders as they look to get rid of homes that are nearly finished or fell out of contract with another buyer.

Why you ask?

New home construction builders throughout Tampa Bay do not want to lose money on homes that have already been built. That's why I get a email list from every Tampa Bay builder in town letting me know which homes have a special rate ties into them (see image below).

How does a higher credit score tier help a first time home buyer get a better rate?

A higher credit score tier can substantially benefit a first-time home buyer by securing a more favorable mortgage rate. Credit scores are a critical factor that lenders consider when determining the interest rate on a mortgage. They are a measure of a borrower's creditworthiness, based on their history of managing debts and making payments on time. Typically, the credit score tiers are as follows:

- Exceptional (800 to 850): Borrowers in this tier are likely to receive the best available mortgage rates.

- Very Good (740 to 799): Borrowers in this tier will usually still receive very competitive mortgage rates.

- Good (670 to 739): Borrowers in this tier may receive slightly higher rates than those in the top tiers, but generally still fair.

- Fair (580 to 669): Borrowers in this tier may find their mortgage rates noticeably higher and may not be approved for all loan types.

- Poor (300 to 579): Borrowers in this tier will find it challenging to secure a mortgage at favorable rates.

By maintaining a high credit score, first-time home buyers can increase their chances of qualifying for lower interest rates, which can save significant money over the long term of a mortgage loan. In addition, having a higher credit scores can lead to the cost of a rate buydown being less expensive then what it would be if you didn't have a higher credit scores.

I don't want you to think that not having a higher credit score will automatically remove you from some of these benefits.

That is not the case.

You want to place yourself in the best situation possible once its time to get started on the journey of looking for a home for sale in Tampa or anywhere nearby.

Ask your lender for a 3/2/1 rate buy-down

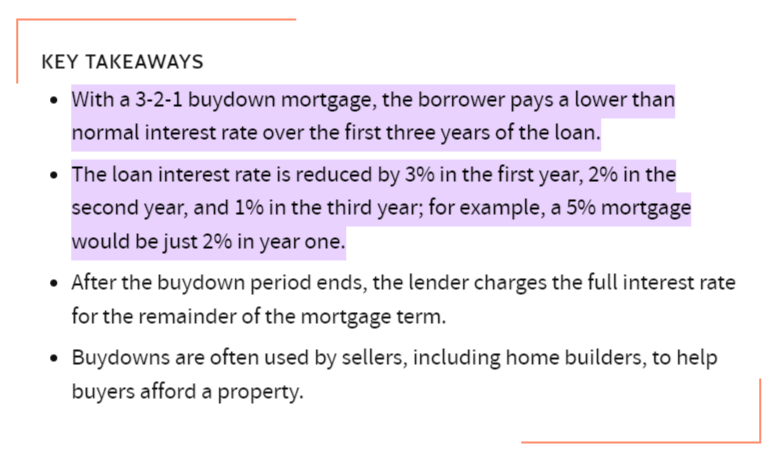

A 3/2/1 rate buy-down is a type of mortgage rate buy-down where the interest rate initially starts lower than the market rate and incrementally increases over the first three years of the loan.

In the first year, the rate is 3% below the standard rate.

In the second year, it increases but remains 2% below the standard.

In the third year, it increases again, this time being only 1% below the standard rate.

From the fourth year onwards, the rate matches the standard market rate.

This strategy can be advantageous for first-time home buyers who expect their income to rise over the next few years. The lower initial rates make the mortgage more affordable in the early stages of the loan, allowing buyers to grow into their mortgage payments.

This approach can be particularly beneficial if the market rates are high at the time of purchase. However, it's crucial for buyers to plan for the incremental increases in the interest rate each year and ensure they can handle the payments once the rate reaches the standard level.

Here is the thing with this strategy.

You don't have to wait until year two or three to lock into a fixed rate. See, most mortgage loans like FHA or conventional financing will allow you to refinance your current loan into a fixed rate after 9 to 10 months of making payments (make sure to check with your lender on that one as rules changes as times passes).

Check our the pros and cons to this strategy here...

Permanent interest rate buy-down

A permanent interest rate buy-down is another strategy that home buyers can utilize to secure lower mortgage rates. In this approach, the buyer or a third party, such as a family member or home builder, pays an upfront fee to the lender to lower the mortgage's interest rate for the entire loan term, not just a few initial years like in temporary buy-downs. The payment made is essentially a form of pre-paid interest.

The main advantage of a permanent rate buy-down is the certainty it provides. Home buyers know their interest rate will stay the same for the entirety of their mortgage, making budgeting more straightforward. This strategy can result in substantial savings over the long term, especially for loans with longer repayment periods and when the market interest rates are high.

However, the upfront cost can be significant, and buyers need to ensure they have enough cash on hand after covering the down payment and closing costs. Home buyers may want to consider a permanent rate buy-down if they have the extra funds available, plan to stay in the home for a long time, and want to lock in a low rate to protect against future interest rate rises.

How credit union have special financing mortgage programs

Credit unions are member-owned financial institutions that often offer special financing mortgage programs. Unlike traditional banks, credit unions operate to serve their members rather than to maximize profits for shareholders. As a result, they are often able to offer more competitive rates and flexible terms.

For first-time home buyers, these special financing programs (called portfolio loans) can make homeownership more attainable and affordable.

For instance, some credit unions offer mortgage loans with lower down payment requirements or loans specifically designed for first-time buyers.

Others may provide loans for homes in particular communities or for low-to-moderate income borrowers. Some will even remove the mortgage insurance portion of a mortgage payment saving you a couple hundred every month.

Additionally, credit unions may offer features such as lower interest rates, smaller origination fees, and reduced closing costs, all of which can make mortgage payments more affordable. They may also provide educational resources and personalized service to aid you in understanding the mortgage process.

Some of the credit unions that I have personally experienced this with my past clients are Suncoast Federal Credit Union and Southstate Credit Union.

Therefore, it's advisable for first time home buyer to consider credit unions when shopping for a mortgage. However, keep in mind that each credit union is different, and it's essential to compare their products, rates, and terms with other lenders to ensure you're getting the best possible deal.

Conclusion

All in all, there are lots of ways that you can help to keep your mortgage payments as affordable as possible. Whether it's builder's incentives, higher credit score, 3/2/1 rate buydown, Permanent interest rate buy-down, or looking into special financing loans at credit unions; these strategies can help make sure you're getting the best deal for your needs.

Don't let higher mortgage rates prevent you from creating a future for yourself and your loved ones. Help is out there if you know where to look so don't hesitate to reach out to friends and experts – we’re ready to provide assistance with whatever type of mortgage payment works best for your situation!

Categories

Recent Posts